does cash app stock report to irs

What if you could use a single cash back app to enjoy a high cash back rate on every purchase. Bitcoin IRA does not list fees on its site but third-party sources indicate that the company charges a one-time fee of 10 to 15 of the initial investment a 240 annual custodial account fee a.

Biden S 80 Billion Plan To Boost Irs Audits May Target Small Businesses

Form 1099-DIV is used by banks financial institutions to report dividends and other distributions to taxpayers and to the IRS in January following a given tax year.

. Stock grants often carry restrictions as well. As the name implies RSUs have rules as to when they can be sold. The IRS said it would host a webinar about stimulus check payments starting at 2 pm.

Cash App Investing does provide an annual 1099-B when you sell stock during a given tax year. Ask your payroll or benefits office if they offer direct deposit. However the IRS postponed the event though it could be rescheduled with a future date to be determined Use the IRS Portal and Get My Payment App.

The app offers 4 cash back on purchases without any rotating offers to keep track of. The online IRS portal for entering payment information and checking on the status of stimulus checks went live on April 15 2020. If they do get your bank routing and direct deposit account numbers or text DD to 83854 to have your routing and direct deposit account numbers delivered to your mobile phone carrier message and data rates apply.

What Is a Bitcoin IRA. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. Slide is a cash back app that promises just that.

Click Sell in the order window on the right side of the screen. A 1099 reports nonwage income from things like freelancing stock dividends and interest. Bank anytime with our mobile app.

The application is called. If you did not sell stock or did not receive at least 10 worth of dividends you will not receive a Composite Form 1099 for a given tax year. The award-winning app allows for the seamless integration of its Cash Discount Program with Clover devices to ultimately provide money-saving payment options for small businesses across the.

Here you can find the stocks historical performance analyst ratings company earnings and other helpful information to consider when selling a stock. Stock dividends are issued in lieu of cash dividends. In other words if you freelanced were self-employed or had a side gig.

Or you can write to. Previously the IRS offered different types of Form 1040 the 1040A and 1040 EZ. Emerging growth company.

Cash contributions and out-of-pocket expenses. Navigate to the stocks detail page. But chasing down deals from different cash back apps can be less enjoyable.

The adjusted basis of the original stock shares is split among the new total of shares including the new stocks issued as a dividend. How your stock grant is delivered to you and whether or not it is vested are the key factors. With a Form 1040 you can report all types of income expenses and credits.

Has issued unusual and significant stock bonuses to some engineers in an effort to retain talent. Changed by events such as stock dividends and stock splits. Choose if youd like to sell in dollars or shares using the drop-down menu.

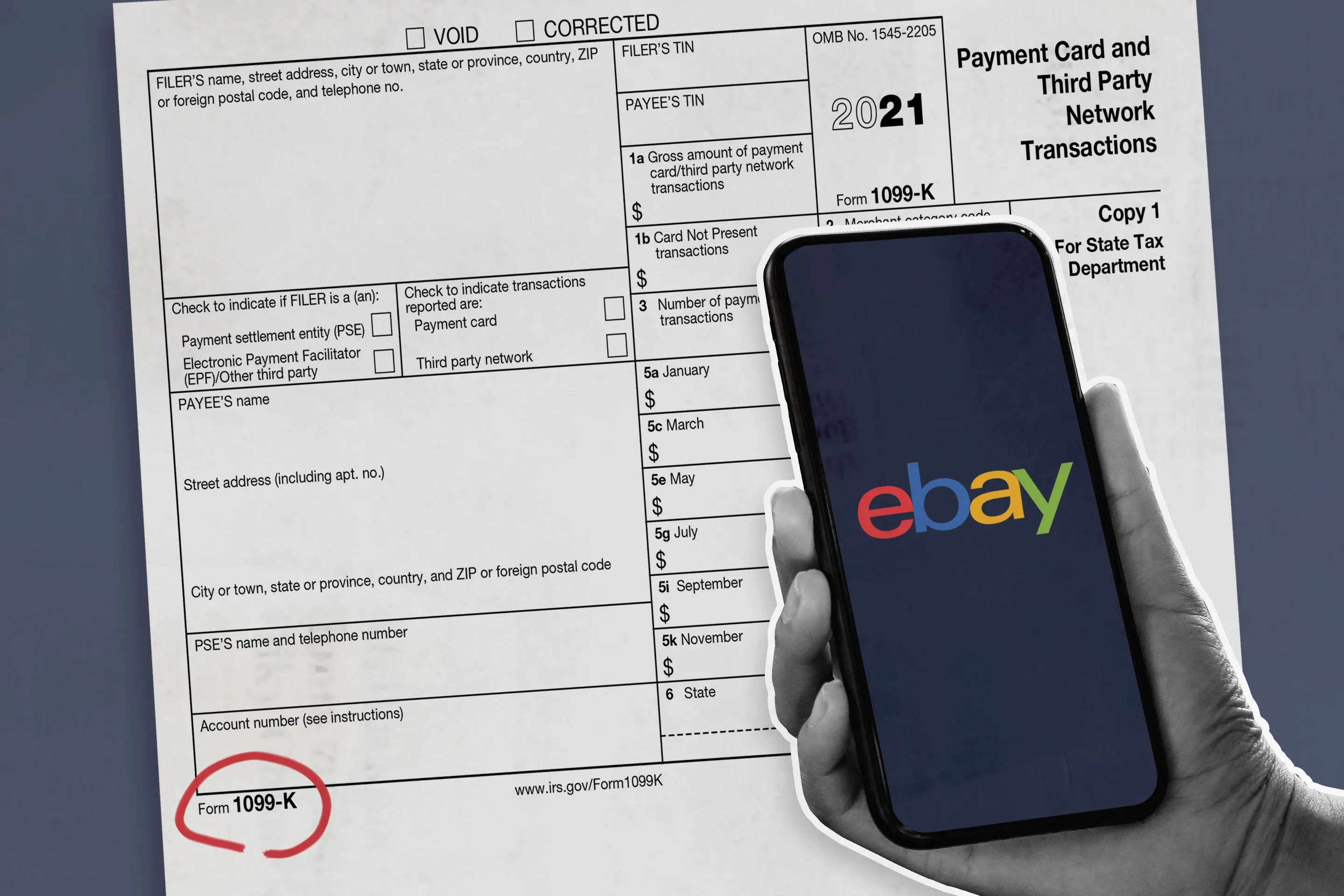

There has been a flurry of furious cash app users this past week angrily responding to rumors of President Joe Bidens new tax reporting plan requiring taxpayers to report all Venmo and cash app income over 600. A Bitcoin IRA is another name for a self-directed IRASelf-directed individual retirement accounts allow you to invest in. These additional shares increase the taxpayers ownership number of shares.

When you sign up for Cash App you must fill out a W-9. Apple issued rare bonuses of restricted stock worth 50K-180K to select engineers after Meta poached 100 Apple engineers over the past few months Apple Inc. Here are the new 1040 form instructions as of 2019 from the IRS.

Although the return of the decedent is a return for the short period beginning with the first day of his last taxable year and ending with the date of his death the filing of a return and the payment of tax for the decedent may be made as though the decedent had lived throughout his last taxable year. New York Stock Exchange. New Form 1040 Instructions.

NW IR-6526 Washington DC 20224. The 1099-B will list any gains or losses from those shares. Does Cash App report to the IRS.

Cash App is a solid offering that allows you to do a lot of things in a no-nonsense app especially if you need core functions banking spending money. Apple App Store Rating. Common Stock 100 par value per share.

One type of 1099 the 1099-MISC typically reports amounts paid to independent contractors. Cash App users can buy and sell bitcoin but Cash App will charge two kinds of fees. The IRS expert compared the restricted stock studies performed prior to 1990the year the SEC implemented rule 144A that expanded the pool of eligible buyers of restricted stockto restricted stock studies conducted between 1990 and 1997 the latter year being when the SEC reduced the holding period under rule 144 from two years to one.

The IRS Is Behind On Processing More Than 55 Million Tax Returns As Oct. The Composite Form 1099 will list any gains or losses from those shares. The right to vote is a substantial right in the.

The IRS has put a question about cryptocurrency holdings on page one of 2020 tax returns that taxpayers are expected to answer accurately. With an online tool from the IRS you can track your stimulus check find out how youre being paid and if you want update your bank direct deposit information to get your stimulus payment as fast as possible. In 2020 the IRS rolled out the 1099-NEC to report money they paid to people who did work for them but werent employees.

You contribute voting stock to a qualified organization but keep the right to vote the stock. This will also be reported to the IRS which is required by law. Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

A service fee for each transaction and depending on market activity an additional fee determined by price Fee Schedule Gold Pricing Cash Management 13 23 33. Cash App Investing will provide an annual Composite Form 1099 to customers who qualify for one. Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 230405 of this chapter or Rule 12b-2 of the Securities Exchange Act of 1934 24012b-2 of this chapter.

If you had income from crypto whether due to selling. ET on Thursday April 23 and there would be a live QA session online.

Don T Believe The Hype Biden S 600 Tax Plan Won T Force You To Report All Venmo Transactions To The Irs

How To Prepare Your Crypto Taxes Bittrex Exchange

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa W2 Forms Irs Forms Irs

Cryptocurrency News Crypto And Visa Pay With Crypto Irs 1040 Crypto Question Cryptocurrency News Visa Visa Card

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Coinbase Report To The Irs Zenledger

New Irs Rules For Cash App Transactions Start Next Year Ohio News Time

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

How To Read Your Brokerage 1099 Tax Form Youtube

Camscanner Understanding Encouragement Scanner App

Why Some Payments Through Cash Apps Will Need To Be Reported To The Irs California News Times

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Cash App Tax Forms All Tax Reporting Information With Cash App